Are custom orthotics covered by FSA?

Asked 3 years ago

Does anyone know if shoe orthotics are FSA-eligible?

I want to get custom shoe insoles/orthotics with my FSA credit. I read that FSA covers insurance payments and medical devices, so I think FSA should also cover shoe orthotics. Do I get orthotics with FSA credit, or should I pay and get a reimbursement?

This is a question for @Upstep, your help is appreciated!

Upstep Staff

Monday, November 15, 2021

Yes, custom orthotics are covered by FSA, so you can buy them with your Flexible Spending Accounts (FSA) funds.

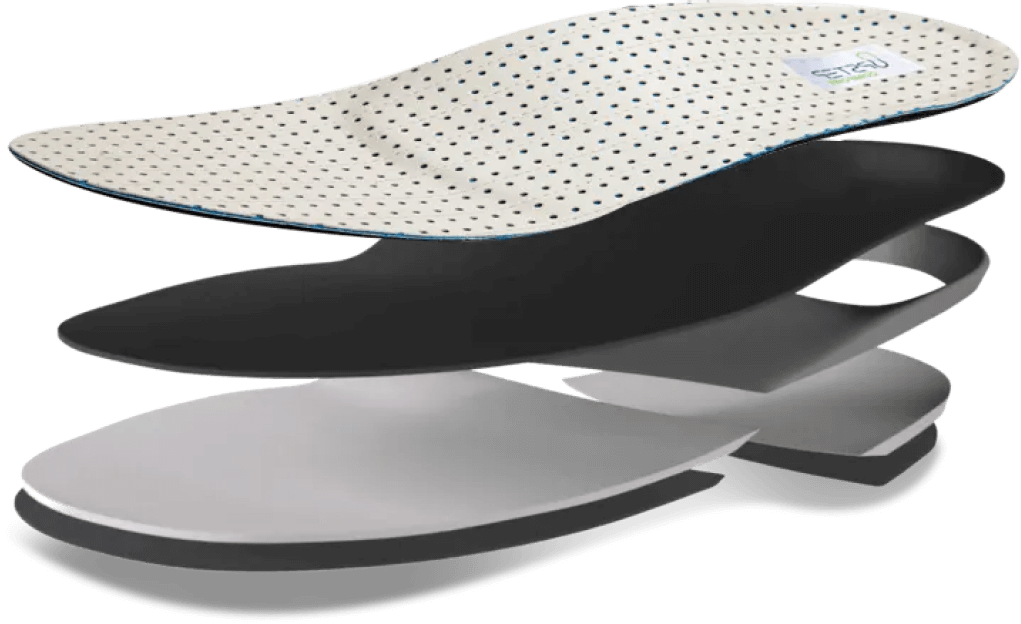

At Upstep, we have orthotics for any type of foot condition or sport, and all Upstep custom insoles are FSA eligible. Aside from being FSA eligible, Upstep's custom orthotics are also covered by Health Savings Account (HSA) and Health Reimbursement Arrangement (HRA).

How to buy custom orthotics with FSA funds?

We provide a seamless and straightforward process for making direct purchases while ordering your orthotic or requesting reimbursement by providing your healthcare provider with the detailed invoice that allows you to obtain reimbursements based on your insurance plan.

- If you have an FSA debit card, complete your purchase as you would with any other credit card.

- If you don't have an FSA debit card, simply complete your order and we’ll send you an itemized receipt after your purchase.

What are the benefits of buying custom orthotics with FSA?

- Funds contributed to an FSA are deducted from your paycheck before taxes. When you use these pre-tax dollars to buy orthotics, you essentially reduce your taxable income, providing savings on income taxes.

- FSAs typically have an annual contribution limit. Planning for orthotic purchases by utilizing FSA funds allows you to budget and use these allocated funds for necessary medical expenses.

- Unlike some medical expenses, orthotics usually don't require a doctor's prescription to use FSA funds. However, it's essential to verify this with your FSA plan, as some plans might have specific requirements.

Jan Hodges

Thursday, November 18, 2021

The FSA Program helps you set aside tax-free funds for eligible medical or dependent care expenses, including custom orthotics. Regardless of the brand or material, if you purchase orthotics with your money, you can request reimbursement provided you can provide the receipt for the purchase on request. Buying custom orthotics from Upstep makes this whole process easy because upon completing your order, they send you an itemized receipt.

Please follow our Community Guidelines

Related Articles

What Is Acupressure and How Can It Relieve Heel Pain?

Babafemi Adebajo

December 18, 2024

Best Insoles for Pregnancy Foot Pain: Relief for Expecting Moms

Janik Sundstrom

December 5, 2024

6 Worst Shoes for Achilles Tendonitis: Avoid Foot Pain

Janik Sundstrom

December 18, 2024

Related Posts

Janik Sundstrom

Best Insoles For Sandals

Babafemi Adebajo

Running Custom Orthotics—2025 Review

Babafemi Adebajo

How Long Does It Take To Make Custom Orthotics?

Babafemi Adebajo

Posterior Tibial Tendonitis: Symptoms, Causes, & Treatments

Staff Writer

Benefits of Cycling Orthotics

Janik Sundstrom

Best Insoles for Burning Feet Syndrome

Babafemi Adebajo

How Long Do Custom Orthotics Last?

Can't find what you're looking for?